Now We’re Talking: Signs of Life in the Art Market

Bitesize | January 2026

A free taster of the Bulletin

Over the past year, the art market has been unusually hard to read.

Headlines have swung between optimism and despair, often on the basis of a single auction result.

And while records fell and auction house revenue picked up, buyers became more selective about when and what they bought.

As art fairs announced expansions into new countries, many galleries closed citing rising costs as a reason they couldn’t continue.

One day the market is back, the next it’s supposedly broken.

This month’s Bulletin steps back from the noise to ask a more useful question:

What was the market actually saying in 2025 – and who was really listening?

Below is a preview of the ground covered in the full edition.

In the Bulletin this month

What last year’s auctions revealed — and concealed — about confidence, pricing, and participation in the art market.

Why some long-standing assumptions about how the art market works are quietly being tested behind the scenes.

How subtle shifts in geography and behaviour may be signalling the market’s next phase.

What the market was really saying in 2025

Rather than treating auction results as isolated wins or losses, the Bulletin looks at them as signals – partial, imperfect, but revealing when read carefully.

Why one strong sale doesn’t mean the market has recovered.

Why one weak sale doesn’t mean confidence has evaporated.

And why so much of what matters in the art market never shows up in headlines at all.

The focus here is not on spectacle, but on how expectations were set – and reset – over the course of the year.

Every edition of The Bulletin is available to members of The Back Room

What we talk about when we talk about price

Every art transaction, whether public or private, is ultimately a negotiation between seller expectation and buyer appetite. In 2025 that conversation stalled – and then, late in the year, began again.

This section explores:

Why sellers held back for so long.

What finally persuaded some of them to take the risk of selling.

And how pricing – particularly estimates – shaped bidder behaviour more than any single artist or category.

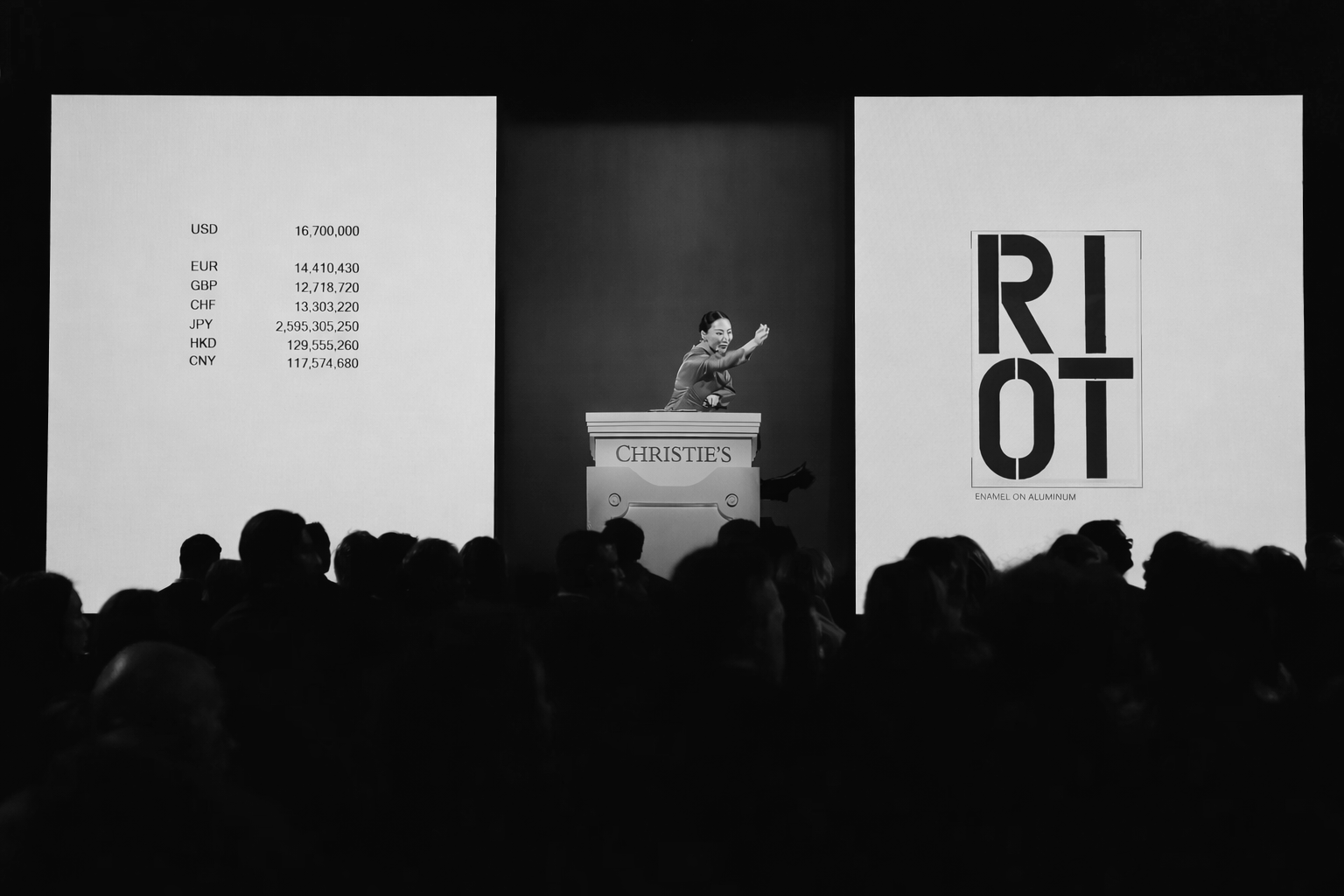

The November auctions are a key reference point here, but not for the reasons most coverage focused on.

Want to know why pricing decisions mattered more than artist names last season?

One result doesn’t rewrite an artist’s market

A record-breaking result can change perception overnight – but perception is not the same thing as value.

Using recent examples from both auction and private sales, this section asks:

Why two works by the same artist can perform very differently, even with identical estimates.

What bidders are really responding to when they compete aggressively.

And why assuming momentum automatically transfers from one work to another is often a mistake.

This is less about winners and losers, and more about how selectively confidence is applied.

Want to know why confidence sticks to specific works, not entire artist markets?

It’s not who speaks loudest, it’s how many join in

Purchase prices tend to dominate post-sale reporting, but they rarely tell the full story. Depth of bidding – how many people are willing to engage – is often a better measure of the market’s prospects.

Here, the Bulletin considers:

Why a crowded bidding room matters more than a single headline price.

What made recent auctions feel different from those of the past two years.

And why opportunity, timing, and context played as much of a role as quality alone.

Some of the most revealing signals this season had nothing to do with records at all.

Want to know why a crowded room tells you more than a record-breaking result?

Finding the signal in the noise

The start of a new year brings a familiar flood of commentary about the art market: trend forecasts, confidence rankings, and long lists of fairs, auctions, and events that promise to define the months ahead. This kind of coverage can be useful as a map of activity, but it often struggles to explain what any of it really means.

Rather than adding another set of predictions to the pile, the Bulletin takes a different approach. Instead of asking what will happen next, it focuses on where the market already appears to be under pressure — moments where behaviour, language, or structure is beginning to shift, even if the consequences are not yet clear.

This section sets out how to look past the sheer volume of data, opinion, and calendar-driven noise, and toward the early signals that may matter more over time. It is less concerned with calling outcomes, and more interested in identifying the areas worth watching closely as the year unfolds.

What happens when old models stop working?

A growing list of gallery closures and downsizings has prompted difficult questions about sustainability.

This section looks at:

Why established models are under strain.

What kinds of alternatives are quietly emerging.

And whether smaller, more focused operations might point to a different future.

Not all of these experiments will last, but some may prove influential.

Want to know why doing less may be the smarter move for many galleries?

Is London still the first stop?

London remains central to the art market, but its role is changing.

This section examines:

How fairs, auctions, and consignments are being redistributed across cities.

Why Paris has gained renewed confidence.

And what these shifts might mean for where value, visibility, and momentum concentrate next.

The answer isn’t straightforward, and that’s precisely why it matters.

Want to know who wins and who loses as the centre of gravity shifts from one city to another?